Raising capital directly from all investors.

Most public companies face this core problem when engaging with their shareholder base during a capital raise.

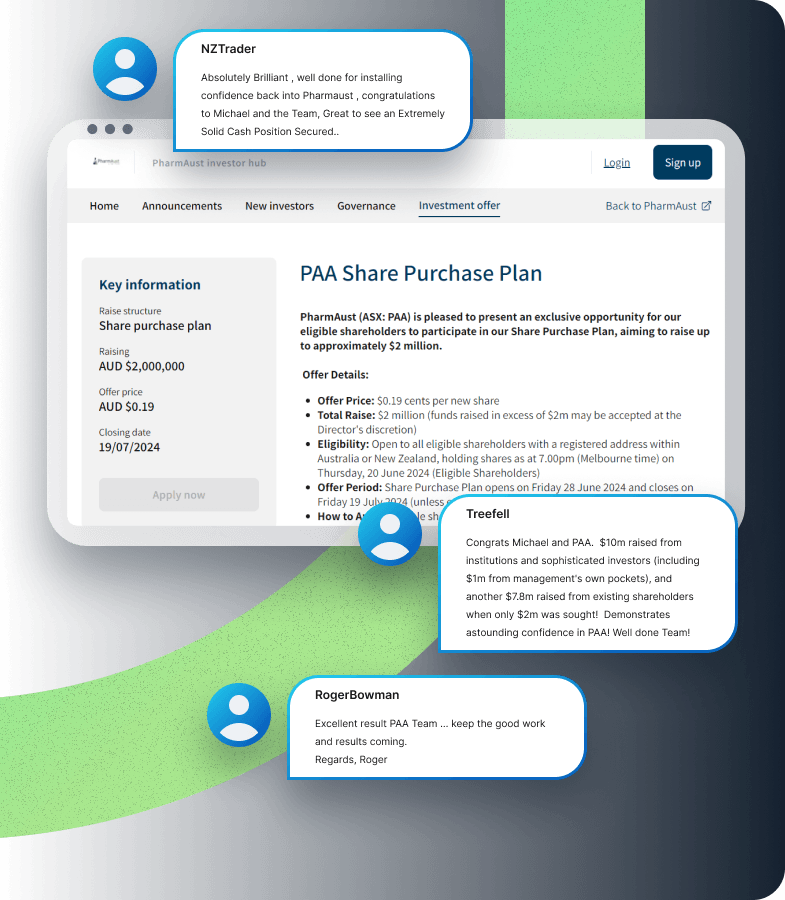

That significant investor demand exists within their existing shareholder base which they're unable to identify or capitalise upon because they lack the direct relationships and the means to build them at scale with investors.

These direct relationships can be hard to build and nurture.

It's why most public companies constrain themselves to only focus on engaging their largest shareholders. It's why they're forced to rely on intermediaries like brokers and investment banks to run their capital raises as placements - paying lucrative fees in the process. It's why they accept new investors into the register who specialise in short-term arbitrage and add selling pressure to the post-raise performance.

But this investor demand can be identified and capitalised upon.

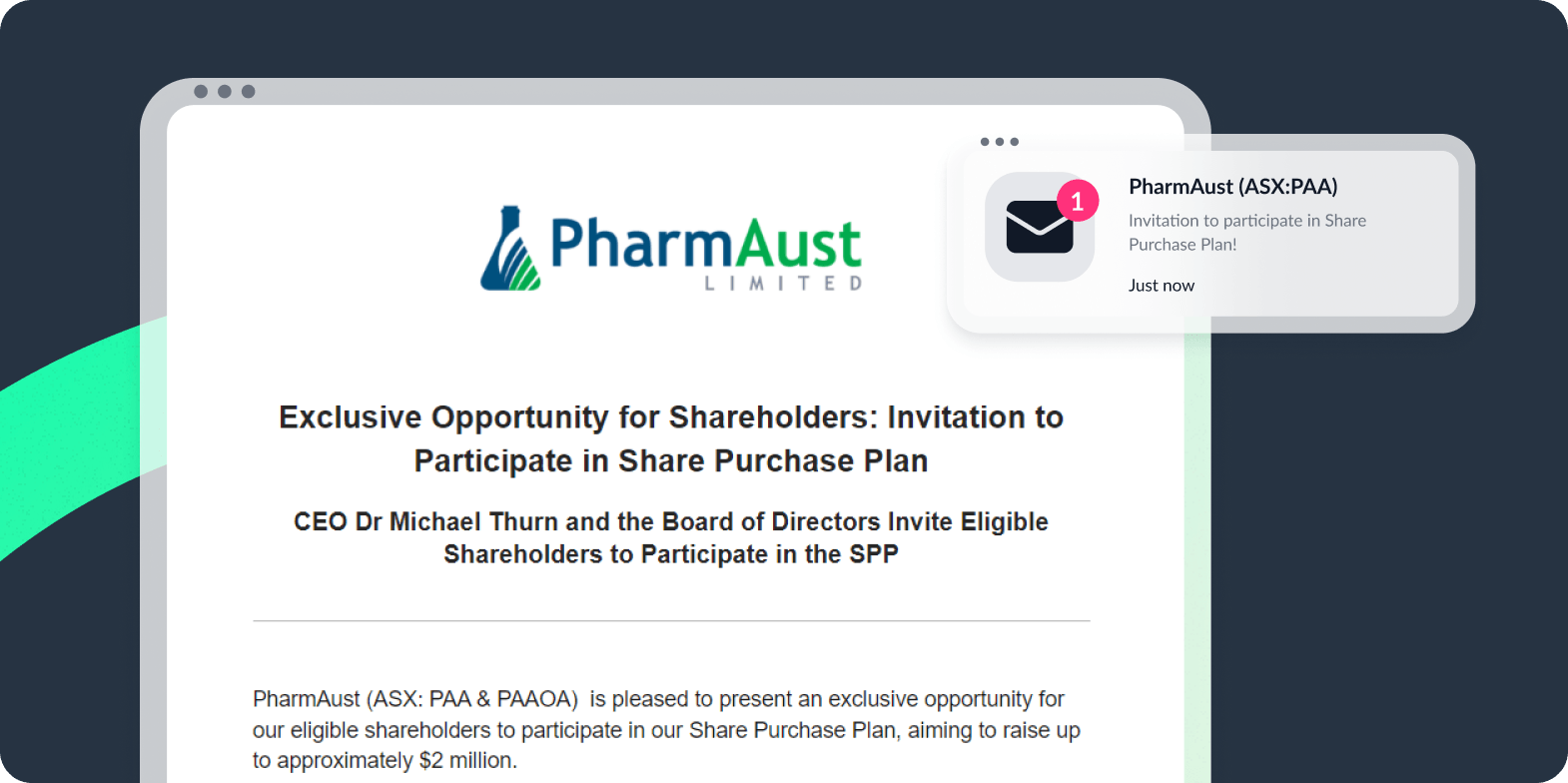

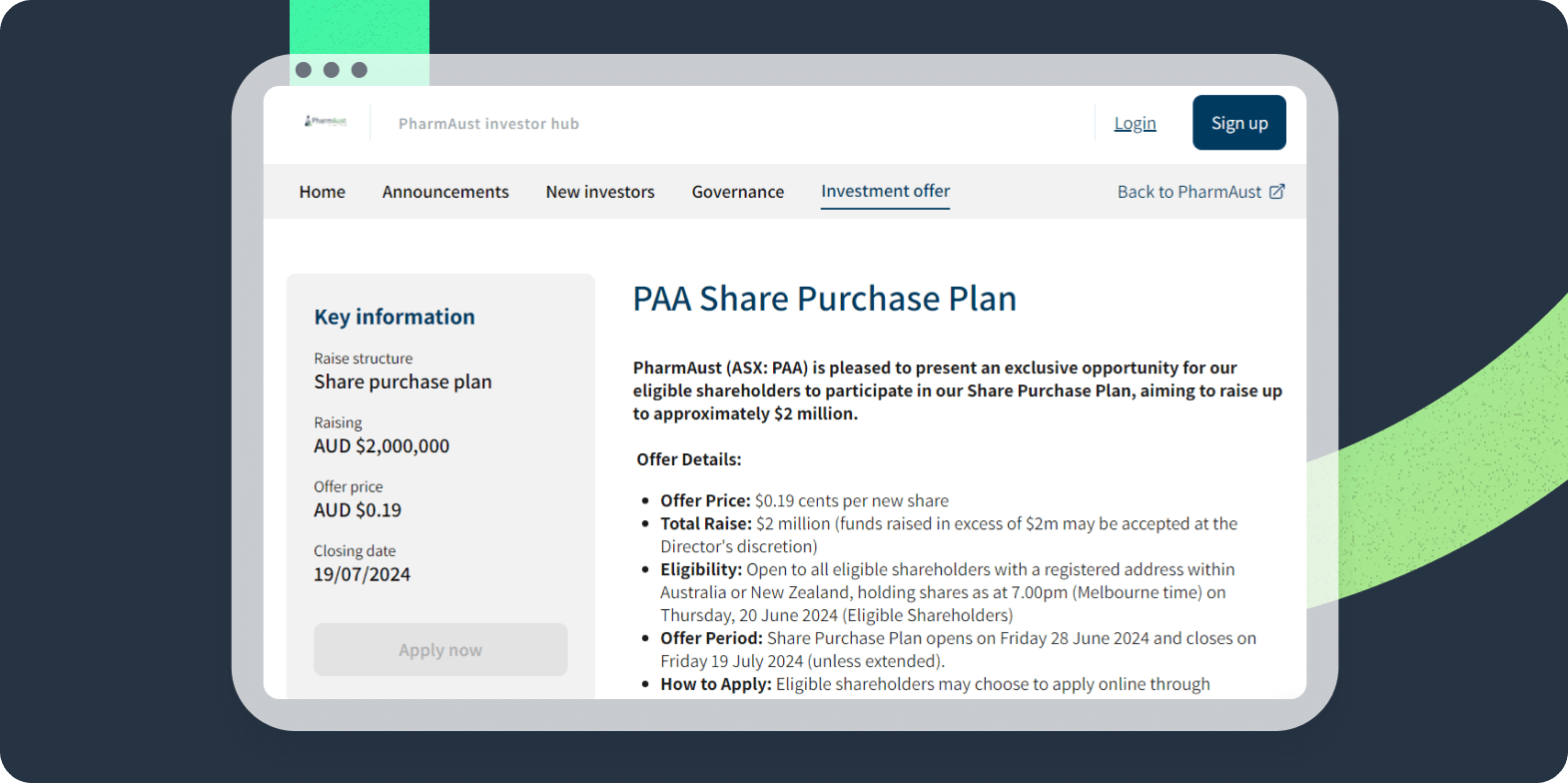

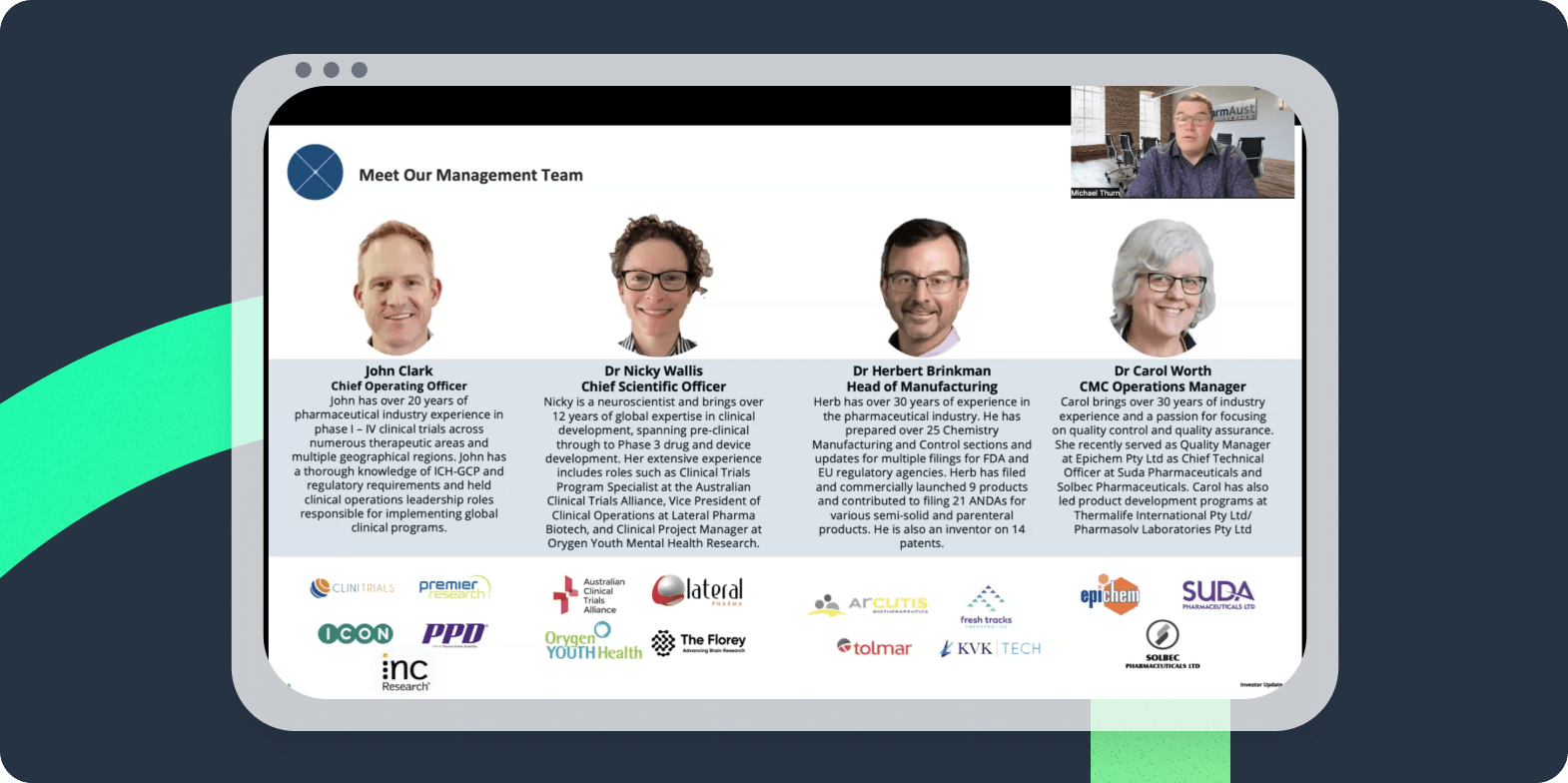

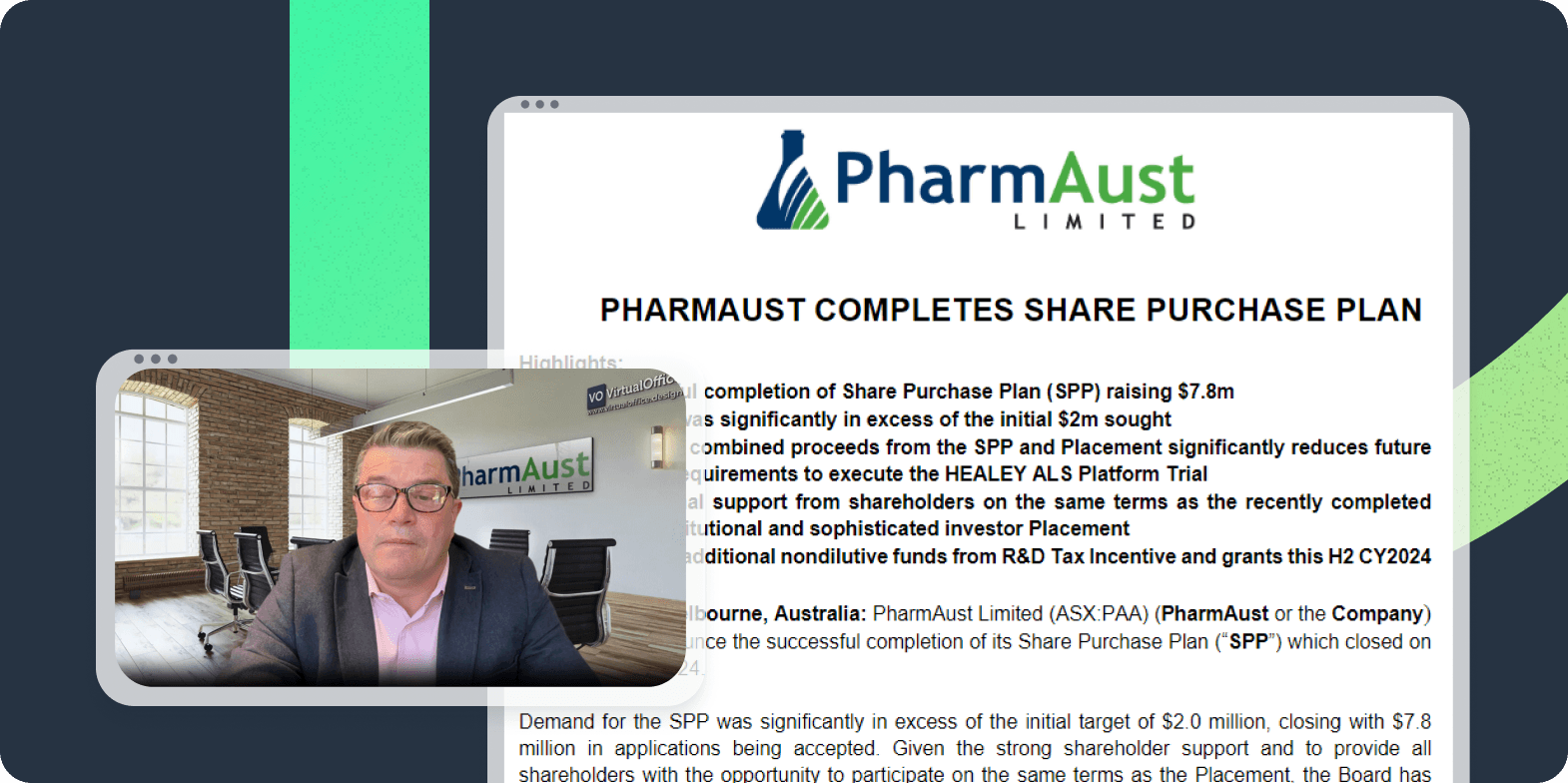

It just requires the right toolkit and approach to leverage company time and effort into building direct investor relationships at scale. Learn how PharmAust (ASX:NUZ) utilised this philosophy during their latest capital raise to source a total of $17.8m in investor demand, including $7.8m from a heavily oversubscribed shareholder offer from existing investors.