Understanding what influences your listed experience.

Being listed can feel like all the downside without any of the upside and it's easy to attribute that as a typical part of the listed experience. You've probably thought "I'd be better off if I stayed private" or even "I wish I only had institutional investors backing me".

When it comes to raising capital, there's an accepted status quo process that looks like this:

- Prioritise institutional and high-net-worth investors.

- Pay fees (6% and/or options) to intermediaries to facilitate a placement.

- Gain access to investors who know nothing about you or your business.

- Experience a muted post-raise share price as traders take profits.

But we're here to tell you it doesn't have to be like this and raising capital shouldn't feel like you're "giving away the farm". There are alternatives like shareholder offers that, whilst rarer than placements, are usually cheaper, result in less dilution, and don't damage the share price as much.

Let's get into it.

Introducing the 'mid-register' when raising capital.

Now more than ever, an optimal capital raise outcome goes beyond just the dollars raised.

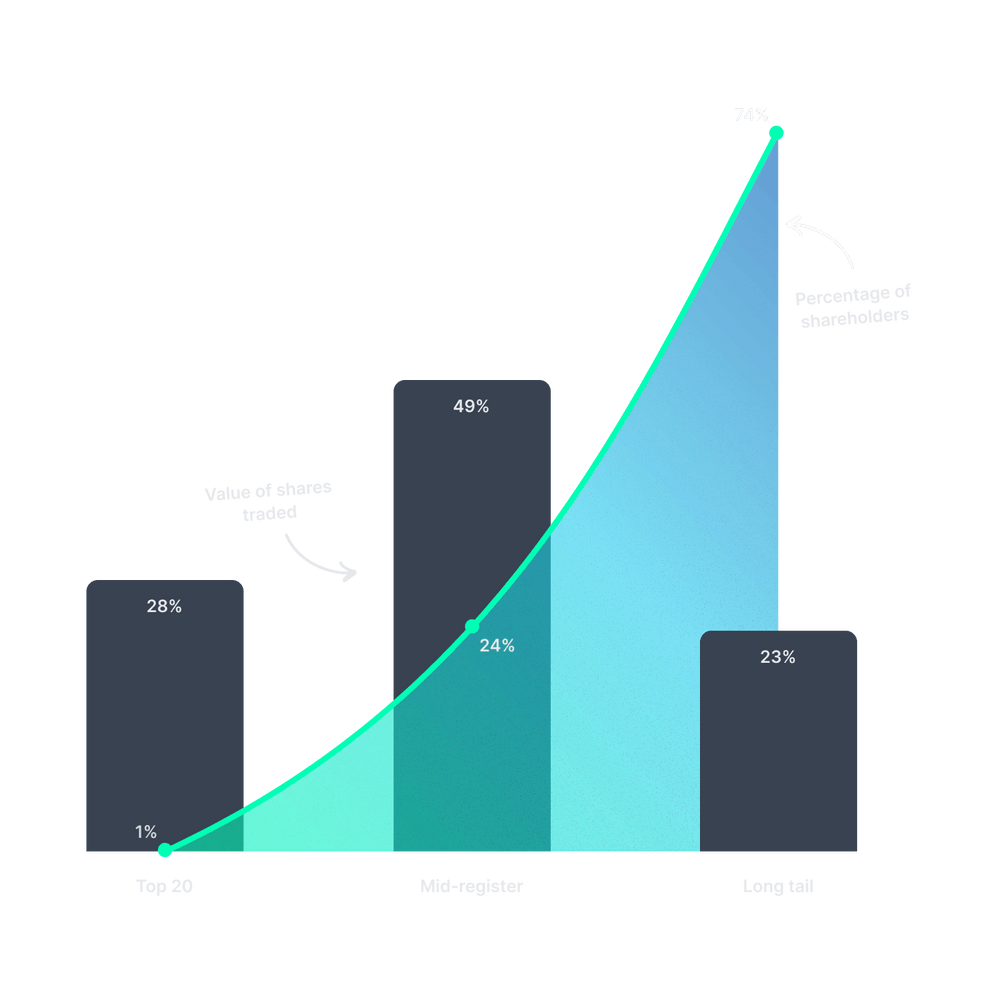

We've identified the shareholders who influence your on-market performance, share price, and liquidity, who aren't restricted to your top 20 or your high-net-worths.

It's a segment of retail investors we call the 'mid-register' and they are possibly the most influential group of investors during a capital raise that you need to be aware of.

If you want to improve your listed experience and how you raise capital, you need to start thinking about the factors that affect your mid-register. Things like dilution, deal structure, and retail inclusion - and not just the dollar amount raised.

Let's talk about shareholder offers.

We ran a four-year analysis of capital raising data, and our findings might surprise you.

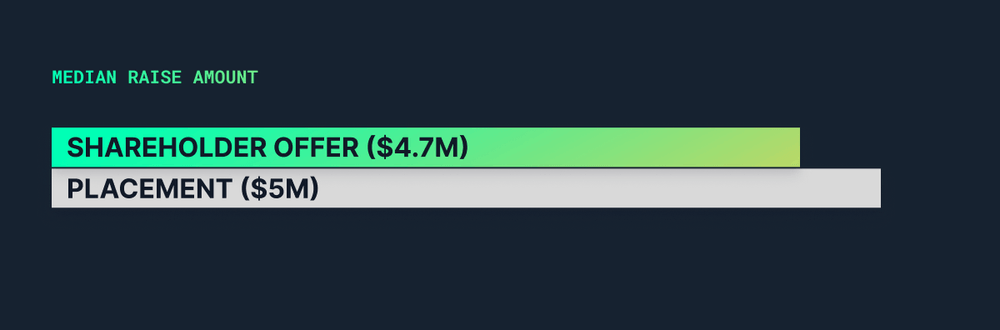

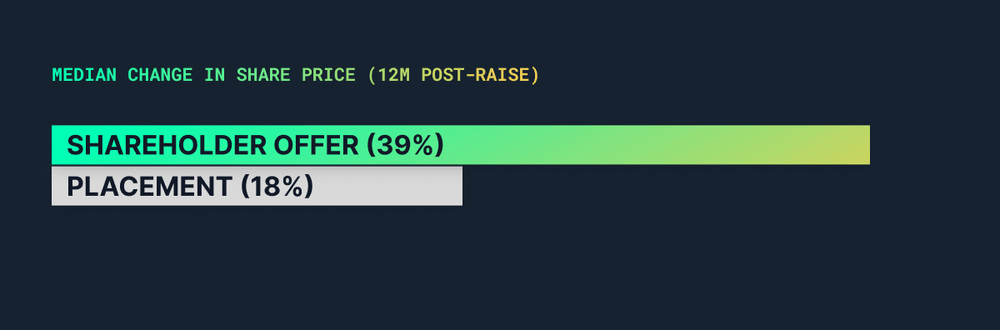

Compared to placements, shareholder offers (like NREOs and SPPs) can raise near-identical amounts of capital. And here's the kicker: they're significantly cheaper, build goodwill with existing resources, and usually outperform placements in post-raise performance.

At InvestorHub, we're seeing this play out with our clients who choose to run shareholder offers instead of or alongside their placements.

- RareX (ASX:REE) saved $100k in broker fees and raised with no discount.

- PharmAust (ASX:PAA) raised 3.9x their original target and reached 20% of shareholders.

- Altech (ASX:ATC) raised 81% of their capital from existing shareholders.

Your capital raising needs to evolve.

The majority of your mid-register is ineligible for placements but they've never been more numerous or impactful in the market. Retail trading activity has only increased each year, accounting for up to 76% of your daily trading volume.

So with a change in shareholder types, companies must be more considered when they approach capital raises:

- Who are you raising capital from?

- What post-raise outcomes do you want to achieve?

- Is your capital raise inclusive of investors and existing shareholders?

- How will this set up future capital-raising efforts and is it sustainable?

Because when a company asks these questions, they start to realise that their retail shareholders are more powerful than ever before. For most companies, the best source of their next capital is already on their register - they just need to be engaged!

The data behind shareholder offers.

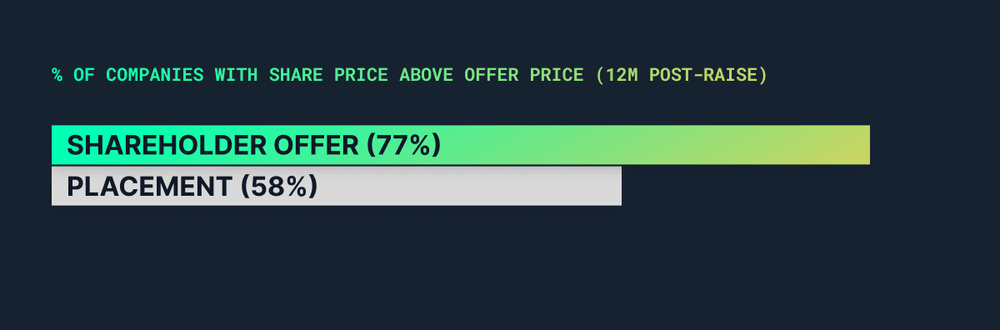

Our analysis of thousands of capital raises between 2018 and 2021 let us understand the performance differentials between raising structures, and what we found was good news for shareholder offers.

Placements are the most common form of secondary raising but we found there's not much difference in the median raise outcome when compared to SPPs or EOs.

More surprisingly, we ran a twelve-month post-raise performance analysis to understand how these companies performed after the raise. As it turns out, shareholder offers outperformed.

Someone might look at this data and assume that SPPs and EOs are the superior offer structure to raise capital, but there is an important point to make regarding bias.

It’s the companies that prioritise all their shareholders, genuinely value sentiment and post-raise performance, and understand how to nurture retail investors, who have an inherently better chance of successfully raising capital from their retail shareholders and mid-register.

SPPs and EOs might be the vehicle, but it’s the company driving the outcome.

They’re leveraging direct-to-investor marketing to directly communicate with and engage shareholders year-round. And in doing so, these companies are growing a ‘latent’ investor demand pipeline that, when it's time to raise, is activated.

In other words, companies are quite literally capitalising on good investor engagement.

And this is how you do it.

Placements may be easier and quicker to execute, but there is a cost for that.

SPPs and EOs require an ongoing commitment from the company because they’re the last action in a series of steps to raise capital from retail investors. The groundwork happens when reaching and engaging investors directly throughout the year - investor demand isn't built overnight!

So if you're committed to including a shareholder offer as part of your next capital raise, you need to leverage the channels that will allow you to scale your investor engagement. Email, social media, and other digital channels all form the most cost-efficient approach, and allow you to target shareholders at different stages of their investor journey.

Here's how you to get started.

Direct-to-investor doesn’t need to be flashy, it just needs to be, well, direct.

Distributing company updates and announcements consistently is a simple and effective way to start a direct investor relationship. Ensure you are always directing investors back to a central location that you own so that you don't need to rely on intermediaries for communication.

Engaging with shareholders is a highly effective way to build trust and conviction. Whether it is answering questions online, releasing newsflow that responds to investor questions, or engaging investors at in-person events, direct investor engagement is highly effective.

Communicating your raise timeline directly to your shareholders gives them the time to prepare for your capital raise and, when done early enough, enables you to gauge investor attention and demand.

Leveraging dedicated raise resources like an SPP landing page (instead of a physical letter) lets you funnel your investors into a capital raise journey where you can maximise participation through better communication and engagement.

Here's what it looks like.

It's always easier to see how this process works in action. We'd recommend you check out these real-world examples from Altech Batteries (ASX:ATC) and PharmAust (ASX:PAA) to see what this looks like in practice.