Why existing shareholders should be the focus of your investor relations strategy.

At InvestorHub, we recently analysed the registry data from over 100 public companies, spanning the past three months, to gain deeper insights into shareholder behaviour.

What we discovered challenges a common assumption among many public companies: that the most effective way to build market momentum is by acquiring new shareholders.

In reality, existing shareholders are responsible for the vast majority of trading volume.

The influence of existing shareholders on buy and sell orders.

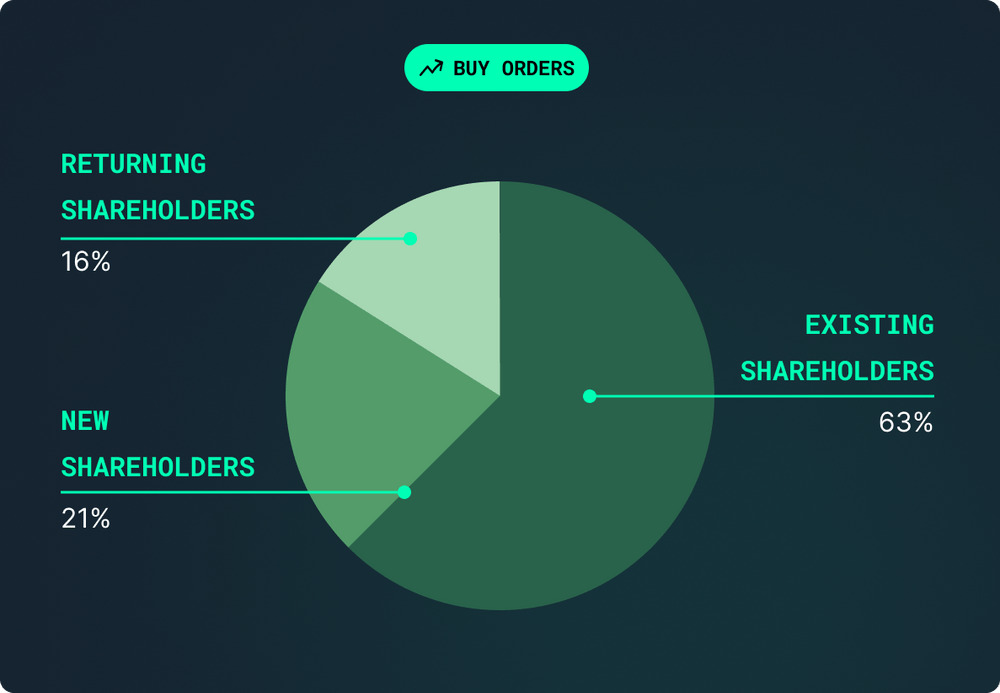

Our research revealed that existing shareholders are the driving force behind the majority of trading activity, accounting for over 60% of buy orders and almost 80% of sell orders.

If you include returning shareholders (aka investors who had previously sold out then bought back in), then the figures are even more striking: between 79% and 94% of a company’s trading volume came from shareholders known to the company.

From an Investor Relations perspective, this data presents a challenge to the status quo mindset of most public companies and instead presents a compelling alternative: companies should focus on engaging existing shareholders, rather than acquiring new ones.

Understanding shareholder segments.

Our prior work analysing registries revealed that, whilst most companies tend to focus on engaging their top shareholders, a group outside of the top are responsible for the vast majority of trading volume.

This group, called the mid register, accounts for 24% of the shareholder base and are responsible for an average of 49% of trading volume on any given day.

In our recent analysis, we sought to identify the influence that the mid register, top 20 shareholders, and the long tail were having on trading volume.

Mid-register shareholders were responsible for the majority of trades. Their consistent buying and selling activity makes them the heartbeat of market liquidity for public companies.

Top 20 shareholders were the next most-frequent traders. Whilst their holdings are significant, holding an average of 45% of issued shares, they tend to be more dormant shareholders.

The long tail of retail investors: typically smaller, individual shareholders only contributed to 5% of trades. While their collective presence is important, their influence on daily trading activity is relatively limited compared to mid and top-level holders.

How to enhance your IR strategy by focusing on existing shareholders.

Given this data, a shift in approach for public companies and their IR teams could be highly advantageous. Here are some practical strategies for enhancing engagement with existing shareholders:

Identify your mid register: repeated analysis of company registries leaves us in no doubt that the mid register is an important segment to engage. They can number in the hundreds or thousands, and are highly influential in influencing on-market outcomes.

Engage your mid register: this group is typically overlooked by most companies and, despite being critical to company growth, are likely to experience an investor journey that is more like that of an unmarketable parcel than a top shareholder. Target this group by offering exclusive roadshows, webinars, and targeted email campaigns that build understanding and conviction.

Use data to identify buy & sell triggers: Given that the majority of trading volume comes from existing shareholders, understanding what drives buying and selling behaviour is critical to optimising your IR strategy. Without it, you may be wasting your time and money on inefficient or ineffective promotional IR.

Conclusion: Focus on what truly moves the market.

Our analysis shows that existing shareholders are not just passive holders: they’re the most influential force on public company momentum. If you are going to allocate time and resources to Investor Relations, then it makes sense to engage the investors that will make an impact.

Whilst acquiring new shareholders certainly adds value, the real opportunity lies in turning shareholders into high conviction believers.