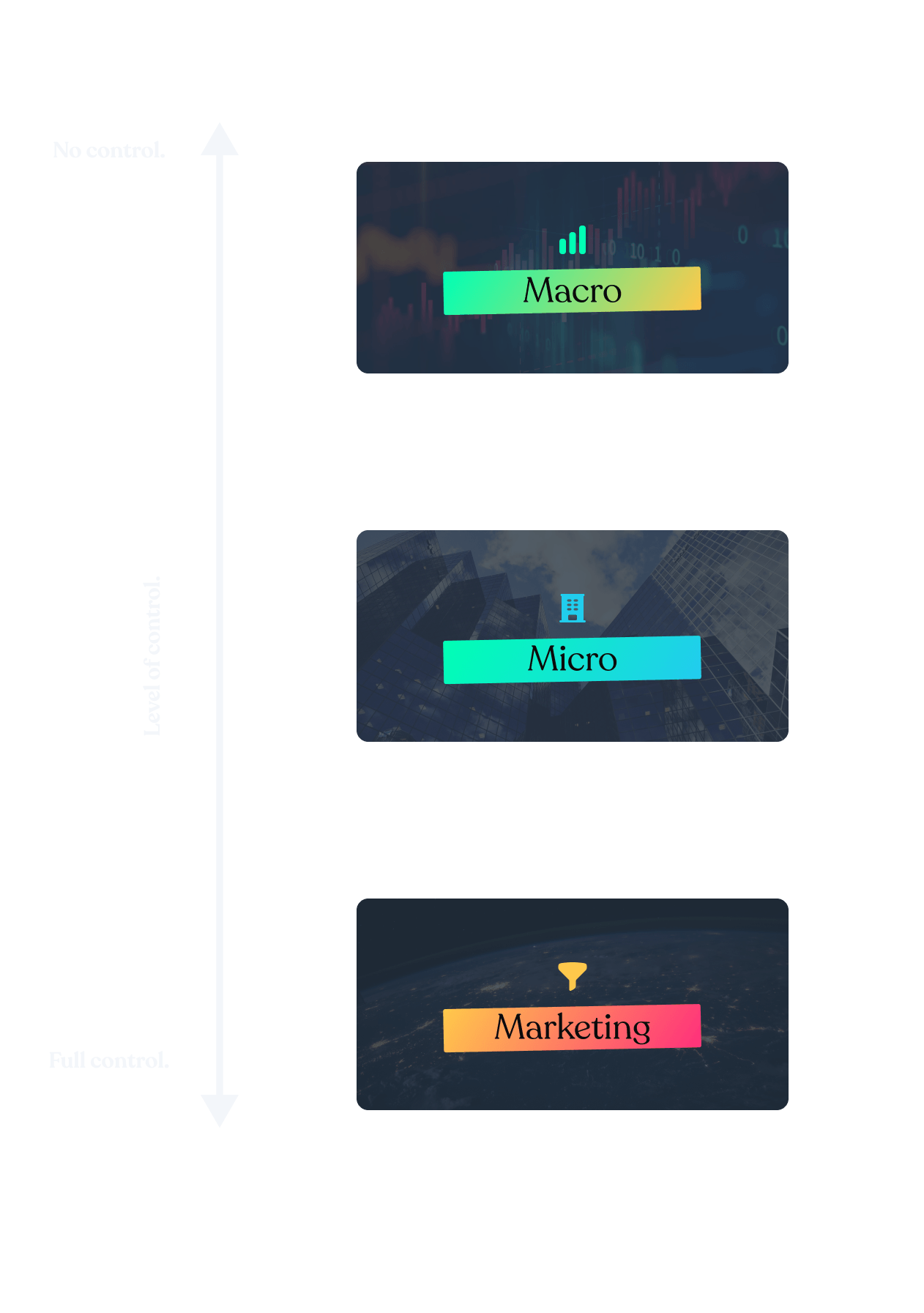

These are typically broad aspects that share two key traits: (a) they

aren't unique to you and (b) you

can't control them.

A financial crisis, market-specific events, regulatory changes, economic data below expectations, commodity pricing, sector impacts - these are all broad-spectrum items that impact your share price, but have nothing to do with you and for which

you can do nothing to influence (though you can acknowledge them, as

ASX:DRE does so here).

Your job here is to (1)

be aware (know what's going on to understand the impacts), (2)

be prepared (these can be large swings, like oil price movements, and rocket up or down), and (3)

take advantage (if your sector is hot, take advantage).

You need to know this, but you cannot influence this, so it shouldn’t change your day-to-day.